It is an accepted fact that one needs to constantly keep upgrading oneself to stay relevant in the industry and progress. Banks are at tipping point of adopting the changes happening in the industry. Digital channels have become “table stakes”, financial institutions must find different ways to differentiate themselves.

Upending conventions, COVID 19 catalyzed the adoption of digital initiatives by companies and has also radically changed consumer behavior. It has effaced slightest of hesitation towards adopting digital, from the minds of the consumers (Of all ages). 35% rise in online banking was observed during COVID-19.

Due to this increased customer expectation, competition from incumbents, technological advancements it is a high time for banks to be nimble enough to embrace ever evolving technology.

The challenge that a lot of financial institutes and banks face is that, while some core processes have been digitized, many others are not yet automated end-to-end. From account opening to small business loans, much of what starts out through an online portal or mobile app is still paper-based processing and done manually.

These gaps in the digital chain hamper the ‘Realtime’ service needed in times of crisis. In response, banks and Financial Institutes are rapidly adjusting their digitization efforts to meet customers in their moment of need.

Top 3 design trends observed in 2020 are:

1. Remote Bank Account Opening

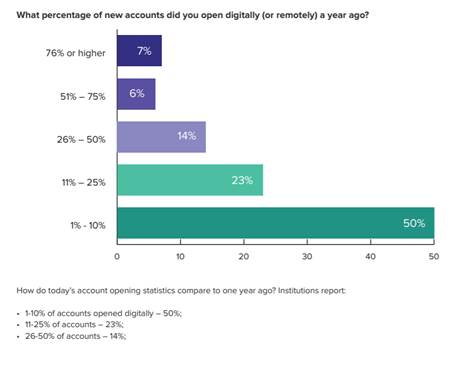

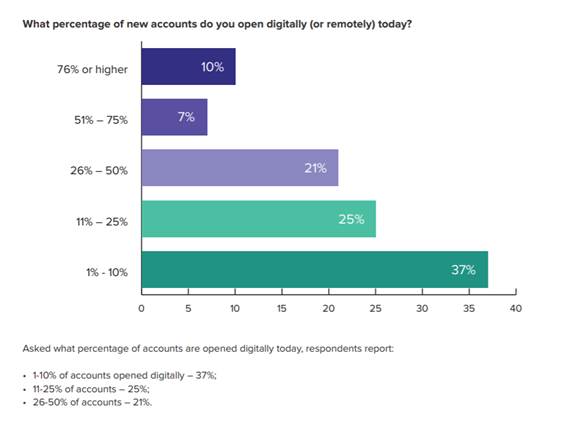

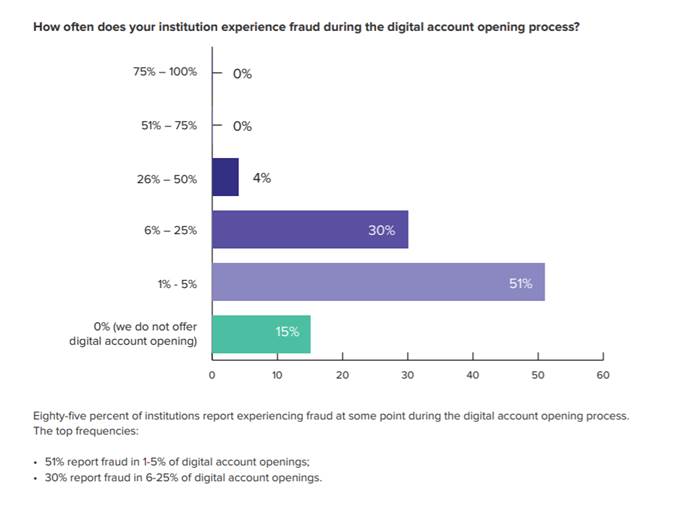

According to a survey, 82% of people are hesitant to visit bank branches during the outbreak. However, the same survey reveals that 63% are more inclined to try an app. 68% of financial institution surveyed have already identified digital account opening as a priority initiative for their institution this year. When asked about the reasons for pursuing digitized account opening process, the responses were, 80% seeking to improve the customer experience and streamline the digital process for new applicants, 72% of respondents indicated that they also sought to cut down on incidents and losses related to fraud.

According to a survey,

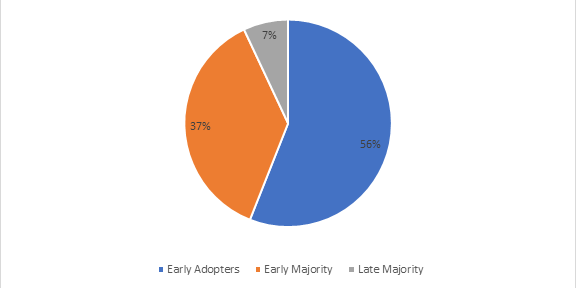

56% are “Early Adopters” – FIs that have embraced digital account opening.

37% are “Early Majority” – FIs that have begun the transformation.

7% are “Late Majority” – FIs that have not yet started to offer digital account opening.

2. Account Maintenance

Banking customers tend to go to the branch to manage changes to existing accounts. Many changes require physical proof and signatures. Such as adding a new spouse to an existing account, also require that the bank verify the new joint account owner’s identity. But with branches limiting hours and customers unable to visit due to restrictions or heath concerns, Financial Institutes have adapted these processes with e-forms, e-signatures, and digital identity verification, so they can be securely and easily executed online.

3. Consumer Lending

Large-scale lockdowns and business closures are affecting household finances significantly. As a result, some banks are offering immediate relief for loan payments. Use of alternate methods for analyzing a customer’s trustworthiness is bolstering the process of consumer lending to reduce NPA.

One area that banks and student loan providers are re-prioritizing is the mobile channel. With so many customers transacting through their personal devices from home, the speed and efficiency of mobile-first lending is gaining momentum.

Challenge:

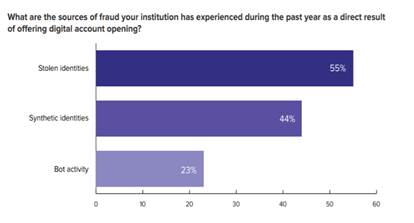

Fraud prevention is a top consideration when automating any financial process. As developers pivot to build out and enhance lending workflows in mobile banking apps, identity verification must be considered seriously. As, according to the survey, most of the frauds faced by banks are stolen / synthetic ID’s. Ensuring an applicant is who they say they are is critical in this time of low-touch/no-touch interaction. When a bank can’t have a physical meeting with the customer, this increases opportunities for fraud. Facial biometrics and digital ID document verification can help the bank ensure an applicant or user is in fact the person they claim to be.

In response to COVID19, financial institutes have shown speed and agility in re-imaging their business models and re-inventing the ways in which their business works, to meet rapidly shifting consumer needs. The above-mentioned initiatives are a few basic ‘must haves’ for banks to survive in the froth coming years. All the institutes who have not embraced this change yet, the clock is ticking!!

Try our 6 months free digital onboarding solution.

Ayesha Kapoor is currently working with IDcentral (A Subex Company) as a growth Marketer. She is a post graduate in management from Symbiosis Institute of Digital and Telecom management with marketing as her majors. She is creative head who loves to read and explore different avenues in the field of Marketing, Branding and Advertising.