Financial institutions are responsible to provide liquidity to the economy and permit a greater magnitude of economic activity. Without financial institutions all the stacks of dough will be stuffed under your mattress, no benefits from fluctuating interest rates could be reaped. These establishments basically conduct financial transactions such as deposits, investments and loans. But this is all majorly for the people with a bank account “What about those who do not have a bank account?”

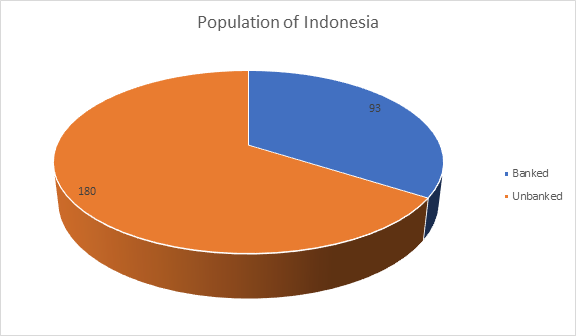

180 million people in Indonesia are unbanked. 5 out of 10 people who are unbanked and are under the age of thirty and are open to digital banking products. Banks are trying to fetch maximum economic value out of this, but the question is how do we get everyone to benefit? The lower income group is actually the one who would be in utmost need of loans but unfortunately, they do not have any credit history so they fail to get qualified for loans.

An Important step for opening up a bank account and accessing financial systems is the confirming of identity and KYC. Without proof of identity, opening bank account is an impossible task. The same goes for credit history which is required as part of the lending approval process. It is impossible to give credit scoring to those without formal income statement such as farmer, mason, auto drivers etc. Now-a- days microlenders are also trying to focus more on growing their loan book size by offering a higher quantum of loans to the borrowers, and overlooking geographical deepening but in spite of all this credibility still remains a question for the unbanked and people with no credit history.

To solve this, technology is definitely opening different gates such as digital lockers that store citizens identification documents. Apart from this, alternate credit scoring can also be used by the financial institutions as a litmus test to check the credibility of the customer. This scoring is given out of the customers socio-economic behaviour such as employment, education, geographic location, and other behavioural metrics such as social media usage/ Appographic interests etc. Through machine learning, credit organizations can create predictive models based on these attributes. A reliable alternate credit score is associated to a person based on these attributes and has the potential to forecast the amounts a person could borrow and the possibility of repayment. IDcentral’s alternate credit scoring methodology provides people with a much-coveted service and allows the organizations to be profitable without having to deal with a lot of extra risks reducing the NPA.

This healthy relationship between financial institutions and unbanked sector gives profit incentives for both parties. The once who are in need of instant money can get their required sum, and banks can increase their customer base yet reducing the risk. Alternate credit scoring can thus be a boon to the banking sector and serve a larger chunk of population.

Find out more on Data-Driven Intelligence.

Ayesha Kapoor is currently working with IDcentral as a growth Marketer. She is a post graduate in management from Symbiosis Institute of Digital and Telecom management with marketing as her majors. She is creative head who loves to read and explore different avenues in the field of Marketing, Branding and Advertising.