What Is Carding?

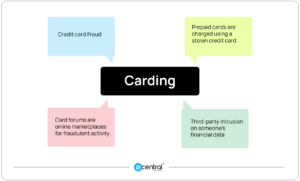

Carding is a sort of credit card theft when prepaid cards or gift cards are charged with a stolen credit card. Carding is the purchase of store-branded gift cards by the holder of the stolen card or card information, which may subsequently be sold to others or used to purchase other things that can be sold for cash. Credit card fraudsters that commit this form of fraud are referred to as “carders.”

The United States is a big target for credit card fraud since it is a huge market with widespread usage of credit and debit cards, and because the cards used in the United States either have merely a magnetic stripe or have a chip and PIN, a type of signature technology instead of the chip and personal identifying number (PIN) technology used in the majority of Europe.

- Carding is a type of credit card fraud when prepaid cards are charged using a stolen credit card.

- Card forums are online marketplaces for fraudulent activity and stolen credit and debit card information.

- Carding is a third-party intrusion on someone’s financial data.

- Card forums are online marketplaces for fraudulent activity and stolen credit and debit card information.

- The use of carders has been thwarted by more recent technology like CVVs, CAPTCHA, and multifactor authentication.

Who are Carders?

A practitioner of carding, in the context of credit card fraud, usually using bots for the carding process discussed below.

What are Carding Forums?

Carding forums are websites where people may exchange information and technical knowledge concerning the illegal trafficking of stolen credit or debit card account information.

Underground web forums are sites for the exchange of illegal services and stolen products. Carding forums, in particular, are noted for focusing on the exchange of financial information. However, there is little information available regarding the merchants that participate in carding forums, the specific items they list, and the prices purchasers pay.

How Carding Works

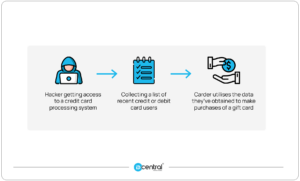

Carding often begins with a hacker getting access to a retailer’s or website’s credit card processing system and collecting a list of recent credit or debit card users. The security software and technology designed to secure credit card accounts may have flaws that hackers might take advantage of. They could also get credit card information by scanning magnetic card strips and copying the data using scanners.

By gaining access to the account holder’s other personal information, such as bank accounts the hacker has previously acquired access to and targeting the information at its source, credit card information may also be hacked. A carder, a third party that the hacker sells the list of credit or debit card numbers to, utilises the data they’ve obtained to make purchases of a gift card.

Most credit card issuers safeguard cardholders against fraudulent charges if a credit or debit card is reported stolen; nevertheless, by the time the cards are revoked, the carder has frequently made a transaction. Gift cards are used to buy high-value items like mobile phones, TVs, and computers since they do not require registration and may be resold later. The merchandise could be received by a third party and then shipped to other locations if the carder buys a gift card from an electronics store like Amazon. This reduces the carder’s chances of attracting notice. The carder may also sell the products on websites that provide some anonymity.

Testing the stolen card information to verify if it still functions is a significant element of carding because credit cards are frequently cancelled shortly after being lost. This can entail making requests for purchases with cards not present online.

How a Consumer Can Prevent Carding Fraud

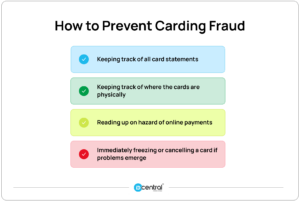

The following additional precautions should be taken by customers to increase their security while using their payment cards both online and offline:

- keeping track of all card statements and investigating any erroneous transactions

- keeping track of where the cards are physically

- reading up on HTTPS, phishing, and other potential hazards of online payments

- activating MFA and/or 2FA wherever possible and requesting from card issuers opt-in security measures, as well as immediately freezing or cancelling a card if problems emerge

How to Detect Carding – as a Company

Best practises and safeguards to identify and stop carding efforts include:

- enriching data to help risk models

- Customers and staff education

- Light, heavy, or mixed KYC verification method