The efficacy of customer identity verification has increased thanks to digital technology. Validating a bank account is an essential stage in the identity verification process since it verifies the client who is tied to that account. The traditional procedures for validating a bank account involved a lot of paperwork and several bank visits, and they were time-consuming.

Financial institutions may now enrol consumers in only a few minutes thanks to the introduction of penny drop verification.

This blog explores penny drop verification, its regulations, and how the process works.

Why is Penny Drop Verification used For Client Onboarding?

Penny Drop India, often INR 1, is put into the bank account as part of penny drop verification, a process used to validate bank accounts. One of the most important needs, for instance, would be to confirm the vendor’s bank account information when registering a new vendor. In order to prevent issues with money transfers for either the company or the vendor, this is done to confirm the account’s legitimacy.

The process not only confirms the legitimacy of the customer’s bank account but also determines whether or not the specified account is active. The process also aids in determining if the submitted account data are associated with the same vendor or not.

How is Penny Drop Verification used?

Penny drop verification is a practical way for companies of all sizes to confirm the bank accounts of their clients. With the use of penny drop, they may confirm bank account information to lower the possibility of future significant losses.

A penny drop can start a number of penny drop transactions, including transfers of insurance funds, requests for partial withdrawals, pension fund transfers, transfers of employee salaries, and many more. In order to ensure that financial transactions only take place between the company and the intended beneficiaries, they can compare the account information they have collected with the KYC proofs and bank account information that has been provided by the customer or employee.

In addition to confirming the information provided by the consumer, this identity verification method helps decrease fraud caused by identity theft. With just a penny drop, organisations can stop the massive losses brought on by erroneous money transfers.

The internal financial operations of a corporation also require the verification of bank accounts. Businesses may utilise penny drops to verify the ownership and bank account details of their employees before starting pay and reimbursements.

Avoiding failed money transfers, wages and costs from being moved to the wrong account reduce stress on the business and the employees.

Why is it important for businesses to verify their customers’ bank accounts?

A company’s primary goal in performing a penny drop bank account verification on a client is to confirm that:

- The customer’s bank account exists.

- By verifying the account holder’s name, it may be determined if the bank account belongs to the same client or not.

- The bank account is open and accepts credits; it is neither frozen nor closed.

Businesses may quickly confirm the legitimacy of their clients’ bank accounts prior to onboarding them before starting a money transfer with a penny drop. In order for companies to be certain that the account belongs to the same client who is signing up for their services, the approach gives accurate results on bank account ownership.

Penny Drop Verification APIs

Bank account verification APIs or Penny drop APIs are used to automate bank account verification, which is typically done manually and takes days to complete.

Before beginning to provide services, these APIs allow financial institutions, including large banks and NBFCs, to promptly and securely validate the bank account information of consumers.

These APIs are simple to implement and frequently don’t need outside help. Additionally, it is simple to include bank account verification APIs into a variety of client journeys to guarantee regulatory compliance and safe authentication.

For banks and NBFCs to automate operations, increase operational capacity, and enhance functionality, bank account verification APIs are easy-to-use and incredibly helpful tools.

How does the Penny Drop Verification process work?

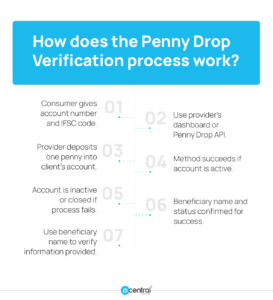

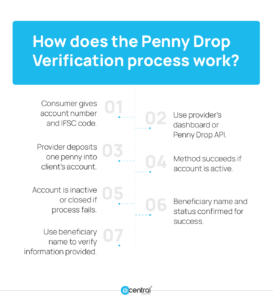

By using a straightforward penny drop method, businesses may rapidly confirm the legitimacy of their client’s bank accounts. The procedure is described in more detail below.

- The consumer provides the penny drop service provider with their bank account number and IFSC.

- The service provider’s dashboard or the Penny Drop API are used to access the penny drop feature.

- The system of the service provider deposits a penny (INR 1) into the client’s bank account.

- If the client’s bank account is active, the penny drop method is successful.

- If the bank account is inactive or closed, the process is unsuccessful.

- The beneficiary name and verified account status are returned following a successful penny drop transaction to confirm the consumer.

- However, just the account status and the reason for failure are returned if the bank account verification fails.

- Businesses can also confirm client information by contrasting the beneficiary name received by the bank with the identification information supplied on the application form.

What is the regulatory requirement for Penny Drop or Bank Verification?

The Securities and Exchange Board of India (SEBI), which oversees the securities and commodities markets in India, expressly advised utilising penny drops to verify bank accounts as part of onboarding investors by SEBI-regulated intermediaries in its KYC circular in April 2020. The beneficiary’s bank account information must be verified instantly using penny drop, according to PFRDA’s VCIP circular from October 6, 2020. As a result, some regulatory organisations in India have required the secure usage of penny drop facilities for Client Verification.

What are the benefits of Penny Drop Verification?

Low operational expenditures and Overheads for the business

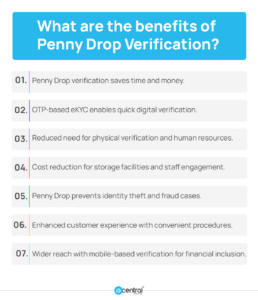

More than 15000 new accounts are opened every day by the biggest brokers in India. Just about the enormous amount of time and money necessary to personally verify those 5000 people and their mountain of paperwork. A Penny Drop device helps you save an enormous amount of money. The Penny Drop verification process only needs your bank account number and IFSC code, and it uses a mechanism to compare the applicant’s name and bank account information with the information in the KYC documents. This eliminates the need for a significant amount of human resources to physically verify the applicant.

With the use of the OTP supplied by Aadhaar Verification, the Penny Drop verification technique also enables OTP-based eKYC, allowing new investors to complete the KYC procedure quickly and digitally.

This eliminates the need for countless trips to the bank, as well as the necessity for bank employees to repeatedly visit beneficiaries’ or investors’ homes as part of doorstep banking. This significantly reduces the expense of engaging staff to carry out the customary KYC procedure.

Additionally, this reduces the cost of building storage facilities for these papers as well as other operating expenditures. According to estimates, eKYC verification costs Rs 15 per person as opposed to Rs 100 per person for physical KYC. Imagine the enormous savings that will result from the use of Penny Drop verification.

Theft Reduction

The OTP-based eKYC has one significant flaw. If a person’s phone or sim card is stolen, a fraudster can use OTP authentication to execute eKYC while assuming the beneficiary’s or investor’s identity.

The Penny Drop mechanism, however, avoids this discrepancy because the impostor stealing the sim card, phone, or other devices would not have access to the banking transaction ID and password needed to complete the Penny Drop verification or the other surrogate questions, such as employment and tax verification to validate the identity.

Financial organisations, especially those who lend to individuals and corporations, carry out the overwhelming bulk of Penny Drop verification. In order to complete the Penny Drop verification, the lender might check the KYC documents with the borrower’s information removed.

This aids in stopping identity theft and fraud cases where a loan is applied for using a fake or stolen name and the bank knows the fraudster owns the account. Consequently, the Penny Drop verification can prevent large losses brought on by identity theft or the theft of phones and sim cards.

Enhanced Customer Experience

OTP eKYC and Penny Drop, as previously noted, are more convenient for consumers and prevent multiple journeys to the bank. Additionally, it eliminates the enormous number of papers that must be sought out and submitted in order to do traditional KYC. The client also won’t have to wait forever to receive the money he needs. In just a few minutes, his account has been credited.

World Bank report on identity verification systems remarked that the more difficult the verification procedures are, the more likely customers are to quit the transaction, either in favour of a more user-friendly experience or by forgoing the service completely.

Therefore, the consumer is more likely to accept the loan or create the Demat account with OTP eKYC and Penny Drop verification because of the lack of difficulty provided to him.

Wider reach

Having a branch in your area may limit your capacity to get loans or create a DEMAT account. With OTP, which is based on eKYC and Penny Drop, you can reach all corners of the nation because the entire procedure is handled by the captivating telephone you hold in your hand.

Indians are utilising cell phones more often these days to access services and commodities. The Penny Drop Verification enables avenues to include more and more people inside the purview of banking and so realise the country’s objective of financial inclusion as a result of the pervasive and continuously growing use of cell phones.

Conclusion

A company can obtain the transferee bank’s confirmation for the cash transfer as well as the user’s information by moving a little sum, say $1, to the bank account given by the user. Businesses may benefit from the straightforward process since it catches errors before large sums of money are moved.

Additionally, a penny drop is essential in stopping fraudulent financial transfer operations if the bank account is that of a con artist attempting to swindle the company. This is crucial for businesses to do in order to prevent unneeded losses. Before carrying out eMandates that would need the firms to make recurring money transfers, the penny drop bank account verification process must also be followed. Long-term, this can help the company avoid unneeded losses.

The KYC customer onboarding process can incorporate the penny drop technique, which is a crucial step that facilitates bank account verification for both the company and its clients.

Try IDcentral’s Identity Verification & Penny Drop Verification API platformRequest a demo

Sumanth Kumar is a Marketing Associate at IDcentral (A Subex Company). With hands-on experience with all of IDcentral’s KYC and Onboarding Technology, he loves to create indispensable digital content about the trends in User Onboarding across multiple industries.